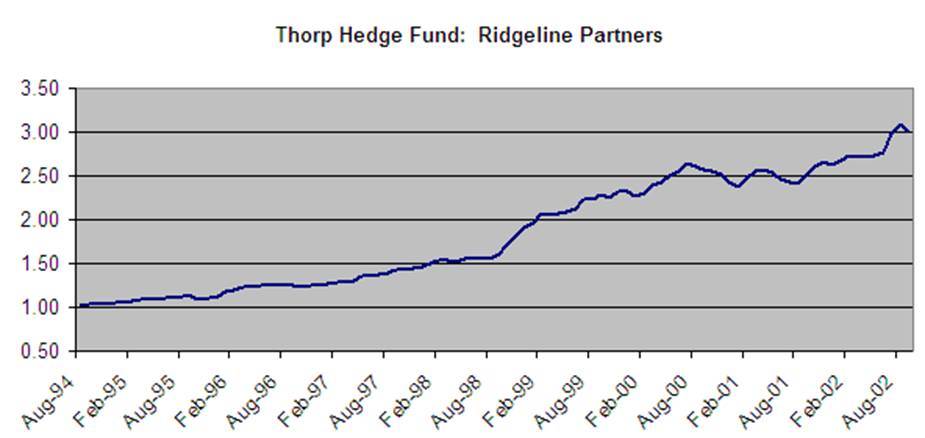

Ed Thorp’s second hedge fund was called Ridgeline Partners and it ran from August 1994 through September of 2002. The fund’s Sharpe ratio over that time period was an eye-popping 1.88, net of all costs & fees. The above graph shows the growth of $1 invested in the fund from its inception until its end.

Thorp's Hedge Funds

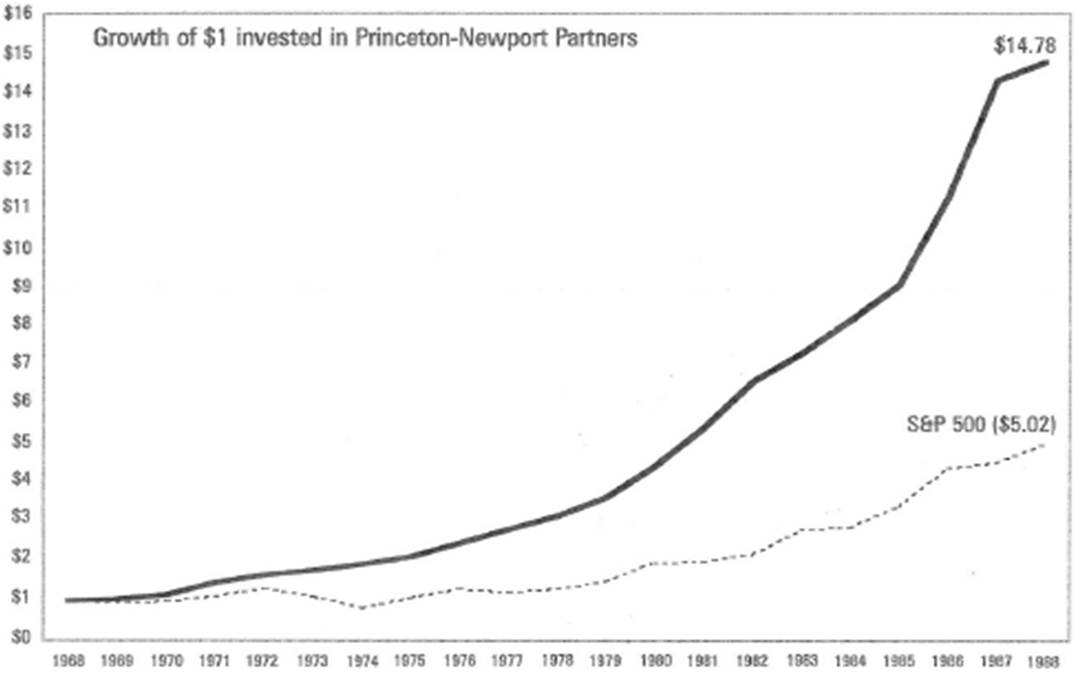

Edward Thorp's first hedge fund was founded in 1969 and originally called Convertible Hedge Associates; the name was later changed to Princeton-Newport Partners. The fund ran until 1989 and over its lifetime compounded at 15.1% annually, after all costs & fees. While this is impressive on its own, what's more impressive is that the annualized standard deviation (a measure of risk) was only 4% over the entire period, so the fund produced a Sharpe ratio of over 3.0...one of the highest ever recorded. The above graph shows the growth of $1 invested in the fund from its inception until its end. (Chart Source: Fortune's Formula - The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street, Hill & Wang, 2005)